OTCBB Penny Stocks Trading Market Makers L2 Charts Technical Analysis Financials Learning Discipline Networking Planning Bankroll Management Taking Profit Paper Trading Options Nasdaq NYSE Small Cap Stock Picks Alerts Bashers Growth Pennystock Sub Penny List Stop Loss Top Hot

Bitcoin Live is now offering a monthly and quarterly option!

SIGNUP bitcoin.live/?aid=107

Finally a project I can get behind. I am honored to be a founding analyst for Bitcion Live. Why should you join? Watch my webinar here:

https://www.youtube.com/watch?v=fhm3ihm2UD0

The complete beginner's guide to "Crypto Currency" trading

By: Cheds

Cheds Trading @bigcheds #chedsblog

What is a "crypto currency"?

According to Wikipedia, - "A cryptocurrency (or crypto currency) is a digital asset designed to work as a medium of exchange that uses cryptography to secure its transactions, to control the creation of additional units, and to verify the transfer of assets."

What is an "Alt-coin"?

Bitcoin, created in 2009, was the first decentralized cryptocurrency. Since then, numerous other cryptocurrencies have been created. These are frequently called altcoins, as a blend of alternative coin.

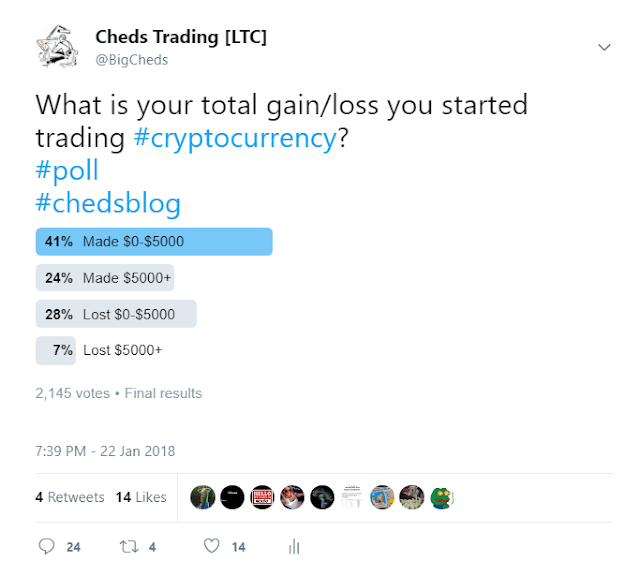

Should you begin trading Cyrpto Currencies?

Below is a poll I did in late January 2018, and as you can see below the majority of people have made money, and that is encouraging.

This is a personal question. You have to decide if the risk outweighs the reward, as this is a very volatile market. You have the chance to make a lot of money but can just as easily lose it all. So, keeping that in mind, never risk any more than you are prepared to lose.

Given that crypto currencies trade 24/7, you may have to be willing to give up some sleep if you want to watch them all the time. That is one downside ...

How do I know which coins are good?

Here are some brief resources to get you started on researching coins -

2) How do I get started?

Step 1 - Deposit Funds

To get started you will need to deposit funds and then transfer them to an exchange. There several choices for which exchange you can use, and I will list them below for you to check out.

Alt-coins are bought with BTC or ETH (Often called BTC Pair or ETH Pair) whereas Major coins like Bitcoin, Litecoin and Ethereum can be bought with USD.

The first step is to deposit funds via USD into a site like Coinbase, GDAX - See below some feedback from my twitter feed about how people got started -

“Very few exchanges in South Africa, usually buy on Luno or Ice3X then move BTC to Binance/Bittrex/Crptopia/

EXCHANGES

The most popular exchanges is Binance.

Below is a very interesting thread where people are discussing which exchanges they like -

https://twitter.com/

Below is a very interesting thread where people are discussing which exchanges they like -

https://twitter.com/

- Binance

Review from August 2017 https://themerkle.com/binance-review-a-pretty-good-platform-for-its-young-age/

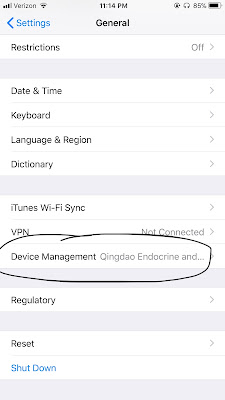

-They have a very good mobile app. For IOS, type in binance in your safari browser and download the app (Not from IOS store). Next, go to settings and general and enable the security feature to allow you to use the app. Select "trust"

-I have heard there is a fee to transfer $BTC to binance, but can not confirm this. There is no fee to transfer $LTC or $ETH.

-One nice feature here is that you can buy the $BNB coin, and save 50% on transaction fees - You buy and sell BTC pairs with the BNB coin.

- Australia- Coinspot

"Coinspot is an exchange based in Australia which accepts Bitcoin, Litecon, Ethereum and many other cryptocurrencies. It has a mobile application as well. Coinspot is fully licensed and trusted exchange operating since December of 2013."

- Mercatox

"Mercatox is a decentralized, peer-to-peer (P2P) cryptocurrency exchange that offers a single trading account with trading fee of 0.25% and two-step authorization process, which is quite common in the crypto-space. It also allows margin trading and offers lending services."

- Kucoin

"Similar to Binance, Kucoin offers both a cryptocurrency exchange platform AND it’s own cryptocurrency."

-Kucoin also has its own coin ($KCS) which you can buy to save money on fees.

- Cryptopia

https://www.yobit.net/en/

Review - https://coinsutra.com/yobit-exchange-review-legit-or-scam/

"In 2015, YoBit was introduced on the BitcoinTalk forum. It offers many of the same features and characteristics of other cryptocurrency exchanges."

Review - https://www.cryptocompare.com/exchanges/quadrigacx/overview

https://www.bitfinex.com/

Review - http://theblogchain.com/bitcoin-exchange-reviews/bitfinex-review/

"Bitfinex is a trading platform that exchanges five pairs at current: BTC/USD, LTC/BTC, LTC/USD, DASH/BTC, and DASH/USD."

Review - https://www.scambitcoin.com/qryptos/

"Operated by Quoine, a next-generation fintech company involved in various blockchain-focused projects, Qryptos is a cryptocurrency exchange which brings quite a few fresh ideas to the table. "

Review - https://bitcoinexchangeguide.com/bibox/

"In its basic form, Bibox can be thought of as an “intelligent transaction platform” that is designed exclusively for blockchain based assets. "

"Livecoin is a Bitcoin and altcoin exchange platform that offers many currency pairs, including trading altcoins for FIAT currency."

Review - https://coinsutra.com/yobit-exchange-review-legit-or-scam/

"In 2015, YoBit was introduced on the BitcoinTalk forum. It offers many of the same features and characteristics of other cryptocurrency exchanges."

- Quadriga

Review - https://www.cryptocompare.com/exchanges/quadrigacx/overview

- Bitfinex

https://www.bitfinex.com/

Review - http://theblogchain.com/bitcoin-exchange-reviews/bitfinex-review/

"Bitfinex is a trading platform that exchanges five pairs at current: BTC/USD, LTC/BTC, LTC/USD, DASH/BTC, and DASH/USD."

Review - https://www.scambitcoin.com/qryptos/

"Operated by Quoine, a next-generation fintech company involved in various blockchain-focused projects, Qryptos is a cryptocurrency exchange which brings quite a few fresh ideas to the table. "

- CEX

- Bibox

Review - https://bitcoinexchangeguide.com/bibox/

"In its basic form, Bibox can be thought of as an “intelligent transaction platform” that is designed exclusively for blockchain based assets. "

- Livecoin

"Livecoin is a Bitcoin and altcoin exchange platform that offers many currency pairs, including trading altcoins for FIAT currency."

- HITBTC

"HITBTC registerd in the UK in early 2015. The exchange offers USD, EUR, GBP to BTC as well as a collection of the most common crypto to crypto trading pairs. The volume has been steadily rising providing decent liquidity and a narrowing bid ask spread. "

- Bittrex

"Bittrex was founded in 2014 by four security professionals with a shared interest in cryptocurrencies and experience in online security."

- Poloniex

https://www.poloniex.com/

Review - https://www.cryptocompare.com/exchanges/poloniex/overview

"Poloniex is a pure crypto to crypto exchange based in the United States. With a grand redesign in early 2015 the site has added a wealth of features to provide a fully immersive trading experience. "

Review - https://www.cryptocompare.com/exchanges/poloniex/overview

"Poloniex is a pure crypto to crypto exchange based in the United States. With a grand redesign in early 2015 the site has added a wealth of features to provide a fully immersive trading experience. "

- Kraken

"Kraken is a top European based exchange and offers a variety of fiat to bitcoin pairs such as JPY, EUR, GBP and USD. "

- Bit-Z

"According to information that can be found online, the company was founded in 2016, and has its headquarters in Hong Kong"

- C-Cex

"C-CEX is a cryptocurrency exchange, which offers a lot of altcoins, making them a competitor to companies like Bittrex and Poliniex."

- Bitstamp

"Bitstamp is one of the longest-running exchanges in the world–they’ve kept it simple and as a result have picked up some excellent connections in the industry."

- Coinigy

"Coinigy promises a “trade smart, trade simple, and trade safe” experience.

- IDEX

- Paradex

- Local Bitcoins

"LocalBitcoins is a global Bitcoin exchange that gives a lot of options to its users."

- Robinhood

Initially will be available to customers in California, Massachusetts, Missouri, Montana, and New Hampshire.'

What is Arbitrage?

How to best understand working with two prices when thinking about a trade. Example if one is thinking of a BTC/TRX trade. That market needs to be considered as well as BTC/USDT. Thanks for putting this together!

Taxes

CNBC did a video that explains tax implications -

CNBC did a video that explains tax implications -

TETHER

What is Tether? ($USDT) - https://coincentral.com/what-is-tether/

"Tether is a cryptocurrency pegged to traditional fiat currencies and backed 1:1 by reserves of these traditional currencies held in accounts under Tether’s control."

There is a lot of debate about Tether, whether it is a scam or not. Below is a series of links that discuss this topic, and I leave it up to you to decide -

https://www.coindesk.com/tether-confirms-relationship-auditor-dissolved/

https://mashable.com/2018/01/

https://mashable.com/2018/01/

3) Trading Vs Investing

An investor, you plan to buy and hold, or HODL.

If you are a trader, then you use chart and momentum, investors use DD, such as viability of the project and maximum coin supply.

https://twitter.com/PeterLBrandt/status/956195281736839169

https://www.investopedia.com/ask/answers/12/difference-investing-trading.asp

If you are an investor, then I guess the chart does not matter. Your plan is to buy and HODL for a year or many years, and then in theory sell and buy a Lamborghini. Guys like me try to time our entries and take profit when a chart is hot, so here are some ways you can do that.

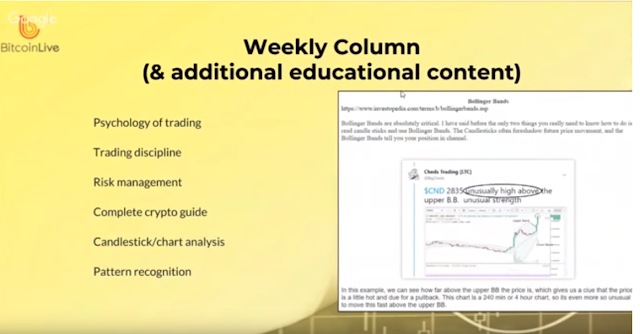

Bollinger Bands

Bollinger Bands are absolutely critical. I have said before the only two things you really need to know how to do is read candle sticks and use Bollinger Bands. The Candlesticks often foreshadow future price movement, and the Bollinger Bands tell you your position in channel.

In this example, we can see how far above the upper BB the price is, which gives us a clue that the price is a little hot and due for a pullback. This chart is a 240 min or 4 hour chart, so its even more so unusual to move this fast above the upper BB.

In this example, we see how sometimes the middle BB(MA 20) can act as support. Three times here it was tested and held as support, so you can watch to see how the price interacts with the middle BB.

The lower BB can often act as support, but when it breaks you are often facing a nice value situation. A general rule of thumb is that when the price is below the lower BB there is a favorable risk/reward.

BB Pinch - For our last example, we see what it looks like when the bands are "pinching" or "Squeezing"

In this case you can see Bitcoin in a bullish flag, and the bollinger bands are starting to squeeze, or pinch (get closer together)

http://stockcharts.com/school/doku.php?id=chart_school:trading_strategies:bollinger_band_squee

As you can see here, the price moved up after the pinch. It does not always go up, it can go down too but the pinch suggests a move either way is coming.

For more, watch this video at Stock Goodies chart school -

https://www.youtube.com/watch?v=wyq9ugZOJVY

In this example, we can see how far above the upper BB the price is, which gives us a clue that the price is a little hot and due for a pullback. This chart is a 240 min or 4 hour chart, so its even more so unusual to move this fast above the upper BB.

In this example, we see how sometimes the middle BB(MA 20) can act as support. Three times here it was tested and held as support, so you can watch to see how the price interacts with the middle BB.

The lower BB can often act as support, but when it breaks you are often facing a nice value situation. A general rule of thumb is that when the price is below the lower BB there is a favorable risk/reward.

BB Pinch - For our last example, we see what it looks like when the bands are "pinching" or "Squeezing"

In this case you can see Bitcoin in a bullish flag, and the bollinger bands are starting to squeeze, or pinch (get closer together)

http://stockcharts.com/school/doku.php?id=chart_school:trading_strategies:bollinger_band_squee

As you can see here, the price moved up after the pinch. It does not always go up, it can go down too but the pinch suggests a move either way is coming.

For more, watch this video at Stock Goodies chart school -

https://www.youtube.com/watch?v=wyq9ugZOJVY

On Balance Volume

https://www.investopedia.com/terms/o/onbalancevolume.asp

On balance volume is a very important indicator to judge the strength or weakness of a move. Some of you may be familiar with "A/D", or "Accumulation distribution". This is basically a better version.

In this example you can see how the price was rising and nearing a resistance area. The strong OBV suggested it had a good shot to break that resistance and go higher, which it did.

Sometimes you will observe the OBV rising before the price rises, and this is called "Bullish Divergence"

https://www.investopedia.com/terms/d/divergence.asp

Shortly after this, the price rose. Additionally you can observe OBV falling before the price falls, and this is called "Bearish Divergence" which is often an early warning sign.

For more, watch this video at Stock Goodies chart school -

https://www.youtube.com/watch?v=d80iVB4qZ24

On balance volume is a very important indicator to judge the strength or weakness of a move. Some of you may be familiar with "A/D", or "Accumulation distribution". This is basically a better version.

In this example you can see how the price was rising and nearing a resistance area. The strong OBV suggested it had a good shot to break that resistance and go higher, which it did.

Sometimes you will observe the OBV rising before the price rises, and this is called "Bullish Divergence"

https://www.investopedia.com/terms/d/divergence.asp

Shortly after this, the price rose. Additionally you can observe OBV falling before the price falls, and this is called "Bearish Divergence" which is often an early warning sign.

For more, watch this video at Stock Goodies chart school -

https://www.youtube.com/watch?v=d80iVB4qZ24

Stochastics RSI

Stochastics RSI is a very important indicator to use for determining the general "over bought" or "over sold" condition of a stock or a coin.

In this example we can see that the StochRSI has bottomed (near the zero), and is giving us a crossing buy signal (red line crossing the black).

In this example we can see how the StochRSI is over-bought and giving us a crossing sell signal with the red line crossing the black line.

To learn more about Stochastics RSI -

https://www.youtube.com/watch?v=KXzWsvhAWv4

Moving Averages Crossing

One very common and effective signal people look for is when moving averages cross.

In this example above you can see I am anticipating the yellow line crossing the blue line which would indicate potential for further upward price movement. Below, you can see we got that cross and some further upward movement.

In the below example, you can see I am anticipating another MA cross, and am pointing out the last time there was an MA cross we saw some nice movement.

http://www.onlinetradingconcepts.com/TechnicalAnalysis/MASimple2.html

Head and Shoulders

Head and shoulders or HnS is a very common pattern. The bearish version is called HnS Top, and the bullish is HnS Bottom or "inverse HnS".

To confirm this bearish pattern you want to see price break and close BELOW the neckline.

Head and Shoulders Bottom or Inverse

Again, to confirm this bullish reversal you want to see price break and close above the neckline.

Three inside/outside up

Cup and Handle

Cup and Handle

Using different time frames

What is the best time frame to use? Well, this is a very difficult question to answer so simply. As a general principal, you want to start with a wider time frame and work your way down. If you are a day trader, typically you want to be using a 4 hour and 1 hour chart, and then when there is heavy volume look even closer with a 15 minute chart. In my experience some of the biggest mistakes I have made came when I was trying to use a 5 min chart and look for trend lines and patterns. It is very easy to get fooled with a 5 or even 15/30 min chart with a trend line or pattern, only to be crushed by the larger trend (4 hour or daily)

Candlestick basics

There are many many different candlestick patterns you can look for, so I will just offer you a few simple ones to get you started.

DOJI

Doji's are often a sign of indecision and potential trend reversal.

https://www.investopedia.com/terms/d/doji.asp- Gravestone Doji

https://www.investopedia.com/terms/g/gravestone-doji.asp

A gravestone doji pattern is a common reversal pattern used by traders to suggest that a bullish rallyor trend is about to reverse.

- Dragonfly Doji

- Shooting Star Doji

- Morning Star Doji

A morning star is a bullish candlestick pattern that consists of three candles.

- Abandoned Baby

A type of candlestick pattern that is used by traders to signal a reversal in the current trend.

Long upper wicks, long lower wicks

As a general principal, long upper wicks are bearish, and long lower wicks are bullish. Here are some examples:

For more information on this topic:

Hammer

A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above or near its opening price. This pattern forms a hammer-shaped candlestick, in which the body is at least half the size of the tail or wick.

Hanging Man

The hanging man looks identical to the bullish hammer, so you have to be careful not to confuse them.

Additional resources:

How to draw a trend line

There are two ways to draw trend line. Using the candle wick, and using the candle body.

Using Candle Wick:

Using Candle Body:

Whats the difference? In classical charting principals the open and close are what matters the most. However, is among many other things in charting is open for debate.

http://www.trade2win.com/boards/forex/174754-bodies-wicks.html

How many points do you need to draw a trend line?

https://www.quora.com/How-many-data-points-do-you-need-to-make-a-trendDebate I had with another excellent trader about how many points you need for a trend line -

https://twitter.com/CryptoYoda1338/status/959084574373482496

5) How to survive a downtrend

Whats the best way to survive a downtrend or bear market? Well the obvious answer is CASH. If you are in cash then you have the most flexibility, but going to cash is not always an option. On exchanges like GDAX you can go to cash, but on other's it can be a bit more tricky.

Tether - On Binance you can sell your coins and move them into Tether or $USDT. Earlier in this article I go into more detail about Tether.

Nubits - On Bitrex, you can move your funds into Nubits, or $NBT, which is basically Bitrex's version of Tether.

Major coins - If you decide to ride out the storm, you can pick which of the 3 major coins are doing the best, and historically it has been $ETH or Ethereum.

HODL - If you are a long term investor and do not really care, then just hold and hold on for dear life.

Below are some other ideas of how to handle a crash -

Tether - On Binance you can sell your coins and move them into Tether or $USDT. Earlier in this article I go into more detail about Tether.

Nubits - On Bitrex, you can move your funds into Nubits, or $NBT, which is basically Bitrex's version of Tether.

Major coins - If you decide to ride out the storm, you can pick which of the 3 major coins are doing the best, and historically it has been $ETH or Ethereum.

HODL - If you are a long term investor and do not really care, then just hold and hold on for dear life.

Below are some other ideas of how to handle a crash -

How to survive a crypto market crash

Shorting - Futures

How can I tell when $BTC #bitcoin is being shorted and how can I track it?

Probably the easiest way to track the futures is by following @whalecalls

You can also follow @WhaleCallsAlts for $LTC $BCH and $ETH

When a short position is liquidated, this is bullish. When a long position is liquidated that is bearish.

BTCUSDSHORTS

BTCUSDLONGS

6) Common Terminology

Pump - Artificial price action. A coordinated effort to move the price up through manipulation and hype. Often times these pumps leave people trapped after they buy new highs expecting the price to continue, only to become bag holders.

Bag Holder - Someone who bought a coin at a higher price and did not sell, and is now "holding the bag". Often times you will hear people talk about being "stuck", or "bag-holding".

Bag Holder - Someone who bought a coin at a higher price and did not sell, and is now "holding the bag". Often times you will hear people talk about being "stuck", or "bag-holding".

FUD - Fear, uncertainty and doubt. Often associated with a campaign to disparage or talk down a certain coin to perhaps drive the price lower by affecting morale. Someone might say, "Ignore the FUD, just HODL"

HODL - "Hold on for dear life" This basically means hold no matter what, even if you are down 90% because in the long run you will be a winner.

HODL - "Hold on for dear life" This basically means hold no matter what, even if you are down 90% because in the long run you will be a winner.

BTFD - "Buy the F'ing Dip" - Basically, if the price goes down buy.

REKT - Basically means you lost all your money, or "wrecked"

Bounce - A recovery and upward price movement.

Leg - Next step in the journey, or next chapter. Often you may see me mention how something may be ready for a new leg, that means it may be ready to move up in the interum. (Re-Do)

Support - Prior area where volume has transacted and the price has bounced off of. When the price is falling you are looking for "support levels".

Resistance - The opposite of support, price area that in the past has acted as a stop signal. The price tried to go higher but was unable to break the "resistance"

Satoshis - (from wiki) The satoshi is currently the smallest unit of the bitcoin currency recorded on the block chain. It is a one hundred millionth of a single bitcoin (0.00000001 BTC) The price of an alt-coin is measured in Satoshis, not USD.

Breakout - Bullish condition where price has broke through resistance and is free to run.

Breakout - Bullish condition where price has broke through resistance and is free to run.

Hammer - A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above or near its opening price.

MA (Moving average) - which is the simple average of a security over a defined number of time periods. Often times people use the crossing of different moving averages as buy or sell signals, such as 20 crossing 50.

Paper Trading - Paper trading (sometimes also called "virtual stocktrading") is a simulated trading process in which would-be investors can 'practice' investing without committing real money. ... Stock market games are often used for educational purposes.

https://en.wikipedia.org/wiki/Stock_market_simulator7) Website Resources

- Coin market cap

https://coinmarketcap.com/

Review - https://steemit.com/bitcoin/@mrwalt/coinmarketcap-com-review-is-it-safe-to-trust-or-are-you-being-mislead

Review - https://steemit.com/bitcoin/@mrwalt/coinmarketcap-com-review-is-it-safe-to-trust-or-are-you-being-mislead

"Bituniverse is part of a chain owned by luckybits and majority of there faucets are also dry."

- Coinmarketcal

Great website, shows you upcoming news and events for coins and tokens.

- Shapeshift

https://shapeshift.io/#/coins

Review - https://coincentral.com/shapeshift-exchange-review/

"ShapeShift is an established cryptocurrency exchange platform that has been in operation since 2015. It aims to make switching between digital assets quick and simple."

Review - https://coincentral.com/shapeshift-exchange-review/

"ShapeShift is an established cryptocurrency exchange platform that has been in operation since 2015. It aims to make switching between digital assets quick and simple."

- Wirex

https://wirexapp.com/

Review- http://www.bestbitcoincard.com/en/wirex-com/

"Wirex – previously known as E-coin – combines digital money with traditional banking services. "- Upfolio

Really cool website that gives you an overview of the top 100 coins.

- Coinscanner

"CoinScanner is a free tool to compare cryptocurrency rates across the web"

- Coingecko

- Changelly

"Changelly is a Bitcoin and altcoin exchange. Users can shift between coins without depositing coins to the exchange."

- Coin Telegraph

Great site for Crypto Currency news

- Bitcointalk

Forum for discussing all things $BTC #bitcoin

- Coins2learn

- Trading view

Awesome website for charting cryptos. You can share chart ideas and learn from others, highly recommend it.

- MISCELLANEOUS

Essay on Crypto market caps

Weiss Ratings -

Website that gives ratings on coins, not sure how valuable though.

Website that gives ratings on coins, not sure how valuable though.

8) Mobile Applications

- Delta

Review - https://medium.com/getdelta/introducing-delta-cryptocoin-portfolio-1-0-for-ios-android-f2c567a7861a

Review - https://www.facebook.com/coinstats/reviews/

Review - http://echeck.org/revolut-review/

"When you sign up with Revolut, you get as many multi-currency accounts as you need, and you get a multicurrency account. When you visit another country, the card acts as if it is from that country and automatically starts using the local currency, even if your online wallet says you do not have that currency in your wallet."

- Coinstats

Review - https://www.facebook.com/coinstats/reviews/

Review - http://echeck.org/revolut-review/

"When you sign up with Revolut, you get as many multi-currency accounts as you need, and you get a multicurrency account. When you visit another country, the card acts as if it is from that country and automatically starts using the local currency, even if your online wallet says you do not have that currency in your wallet."

- Blockfolio

Review - https://steemit.com/cryptocurrency/@lennartbedrage/blockfolio-app-review

"Whether you're just getting started or you utilize multiple exchanges across numerous countries and bank accounts (like I do), understanding how price swings and news has affected your Cryptocurrency portfolio is essential. Lucky for us, there's Blockfolio!"

Review - https://www.pcmag.com/review/342992/telegram-messenger-for-iphone

"The Telegram iPhone app balances security and fun with easy messaging and a novel decentralized system that allows anyone to create and share sticker sets."

Review - https://bitcointalk.org/index.php?topic=1958486.0

"TabTrader is a FREE trading terminal for bitcoin (altcoin or cryptocurrencies) exchanges "

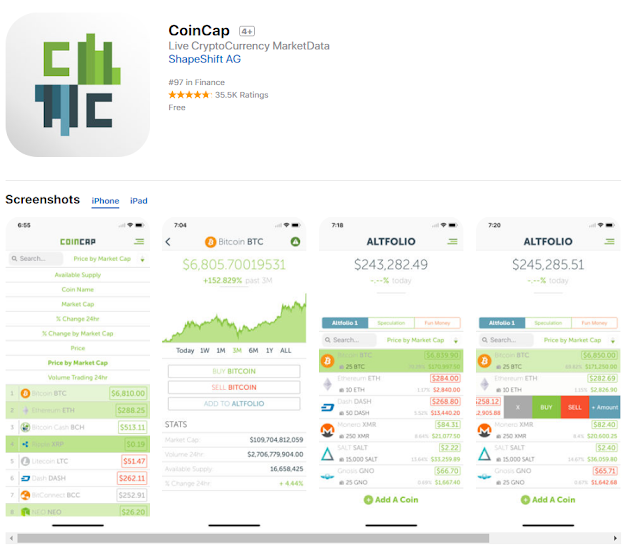

Review - https://steemit.com/coincap/@glennolua/coincap-app-review-better-than-blockfolio

Review - https://steemit.com/cryptocurrency/@parkermorris/altpocket-io-the-best-way-to-view-your-altcoin-earnings

"Altpocket.io is an amazing website where users can keep track of their investments by either entering them in manually, or by having them automatically entered and calculated by using Bitrexx's API."

Review - https://www.producthunt.com/posts/coindex/reviews

"Whether you're just getting started or you utilize multiple exchanges across numerous countries and bank accounts (like I do), understanding how price swings and news has affected your Cryptocurrency portfolio is essential. Lucky for us, there's Blockfolio!"

- Telegram

"The Telegram iPhone app balances security and fun with easy messaging and a novel decentralized system that allows anyone to create and share sticker sets."

Review - https://bitcointalk.org/index.php?topic=1958486.0

"TabTrader is a FREE trading terminal for bitcoin (altcoin or cryptocurrencies) exchanges "

- Coincap

Review - https://steemit.com/coincap/@glennolua/coincap-app-review-better-than-blockfolio

- AltPocket

Review - https://steemit.com/cryptocurrency/@parkermorris/altpocket-io-the-best-way-to-view-your-altcoin-earnings

"Altpocket.io is an amazing website where users can keep track of their investments by either entering them in manually, or by having them automatically entered and calculated by using Bitrexx's API."

- Drakdoo

- Coindex

Review - https://www.producthunt.com/posts/coindex/reviews

- Enjin Wallet

"Enjin is a mobile wallet for Ethereum-based tokens, Bitcoin, Litecoin and Enjin Coins. "

Why do I need a cold wallet?

How and where you store your funds is something very important to think about. If you are primarily an "investor", then you should be holding your funds off-line via "cold storage". If you are a trader, then it makes more sense to use "hot storage". (work on this more)

Scams

There are a lot of shady people out there trying to take your hard earned money. Be careful!

https://twitter.com/satoshilite/status/958170338621145089

Cold Wallet Options

Ledger Nano S- Company Website

Review - https://99bitcoins.com/ledger-nano-s-review-bitcoin-wallet-better-than-trezor/

Here are some comments about Nano S from users on my twitter feed -

Ledger Blue- Company Website

Trezor - Company Website

Here are some comments about Trezor from users on my twitter feed -

Keep key - Company Website

Here are some comments about Keepkey from users on my twitter feed

Electrum - Company Website

My EtherWallet- Company Website

Exodus - Company Website

Paper Wallets

What is a paper wallet?

"In the most specific sense, a paper wallet is a document containing all of the data necessary to generate any number of Bitcoin private keys, forming a wallet of keys. However, people often use the term to mean any way of storing bitcoins offline as a physical document. This second definition also includes paper keys and redeemable codes. A paper key is a single key written on paper that is used multiple times like a wallet (this is strongly discouraged). A redeemable code is a single key intended to be funded and "redeemed" only once: these are commonly used for gifts and as part of physical Bitcoin coins/notes."

Bitcoin Paper Wallets - Company Website

Security

- One good tip to avoid getting phished is to use a different email address for each exchange, that way if one account is hacked they will not be able to access the other ones

- Make sure to use 2FA, or 2 factor authentication. What is 2FA?

Two-factor authentication: What you need to know (FAQ)

https://www.cnet.com/news/two-factor-authentication-what-you-need-to-know-faq/

10) Beginner Mistakes

There are many common beginner mistakes, but the good news is you may be able to avoid repeating some of them by studying up ahead of time.

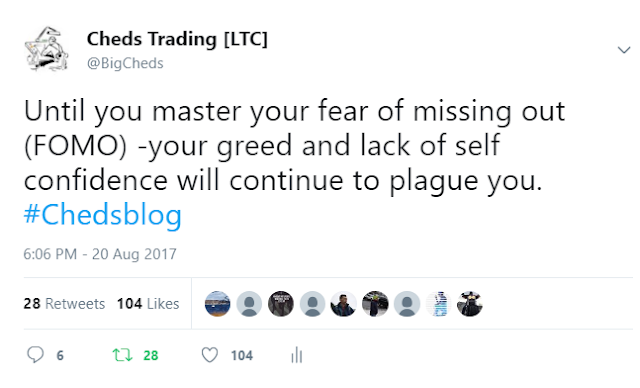

FOMO Chasing

FOMO stands for fear of missing out. This is one of the most deadly mistakes you can make and is very hard to avoid. Once you see a stock or coin running is it very hard to avoid jumping in because you don't want to miss out, even though the timing of your entry is likely way off.

Not taking profit

It is absolutely critical that you protect your bankroll by taking profit. Even though you may feel that a coin or stock will continue to run, you must protect yourself against downside by selling some when you are up. One of the most common strategies in this regard is to sell half when you are up 100%, however you do not always get that chance.

Playing pump and dump plays

Playing a pump and dump can be risky business. If you know ahead of time when it is going to happen and you can get a good entry (based on the chart). The danger lies in the fact that at some point those who are artificially driving the price up will "pull the rug" -

Too many eggs in one basket

Some people believe they have found a "hidden gem" and put all their funds into one play. This is a huge mistake as things can go south for you very quickly, and it is important that you hedge your bets and spread your funds around.

The value in having your funds spread out (not only in several plays but also cash) is that you do not become overly emotionally attached to any one play, as well as not having your bankroll be dominated as much by swings.

The value in having your funds spread out (not only in several plays but also cash) is that you do not become overly emotionally attached to any one play, as well as not having your bankroll be dominated as much by swings.

Buying based on USD price

Even though it may be hard to wrap your head around this, you should be basing your entry and exit based on the chart, and the chart functions on satoshis not on USD. If your coin is currently trading at 3000 satoshis and Bitcoin loses 30% value, then your coin loses 30% value. The support and resistance points on the chart are based on satoshis, so that is what you should be using to plan your entry and exit.

Not keeping extra cash just in-case

You never know when there is going to be a flash dip or flash crash and you might be able to gather some more coins at a discount price, which is why you always want to leave some funds available to take advantage of that. See below, where I made a nice 50% trade because I had funds available.

You never know when there is going to be a flash dip or flash crash and you might be able to gather some more coins at a discount price, which is why you always want to leave some funds available to take advantage of that. See below, where I made a nice 50% trade because I had funds available.Not using a stop loss

It is very important to have a stop loss level in mind when you enter a play, especially if you are a trader. Your stop loss should be based on key chart levels where a break of a certain level would indicate a failed trade and future downside.

Using 1 min or 5 minute chart

When using a smaller time frame such as a 1 or 5 minutes you are going to be receiving a lot of false signals. It is important to zoom out and always keep a larger time frame in mind.

Comparing yourself to others

It is easy to get frustrated when you see someone else on your twitter feed doing well when you are struggling with your own trades. Avoid that type of thinking, as you can only walk your own path and the only thing that matters if if you are reaching your own potential.

Overtrading

Over trading can be a traders worst nightmare. Enter a play, then second guess yourself and exit, only to jump back in as soon as it starts moving. Forcing your entry or playing something just because you are bored, these are habits that will really come back to bite you.

Self-Punishing

It can be incredibly annoying to sell a stock/coin only to see the price go up. There is nothing you can do to control this, so my advice is to make a decision and stick with it. Once you have sold something, move on. Judging yourself with the benefit of hindsight is an unnecessary exercise.Misc Resources:

OTCmarkets

Stock Wiki

American Bulls: (Candlestick Analysis)

Barchart

The 9 Best Kindle Trading Books for $2.99

Stockgoodies Chart School

Stock Goodies Youtube Videos

Welcome to Chedsblog!

-Helping new traders avoid my old mistakes-

OTCBB Pennystock trading article topics include:

Reading financials and filings

Market makers

L2 and chart analysis

Understanding the competition

Using social media to trade

Price and volume study

Bankroll management

Game theory

Sub .01 low float setups

Interviews with influence makers

OTCBB Penny Stocks Trading Market Makers L2 Charts Technical Analysis Financials Learning Discipline Networking Planning Bankroll Management Taking Profit Paper Trading Options Nasdaq NYSE Small Cap Stock Picks Alerts Bashers Growth Pennystock Sub Penny List Stop Loss Top Hot